JPMCB Card Services, a trusted name in the financial industry, offers a wide array of credit card solutions tailored to meet the diverse needs of consumers. From cashback rewards to travel perks, JPMCB card services stand out for their flexibility, security, and customer-centric approach. Whether you're a first-time credit card user or a seasoned cardholder, JPMCB ensures that its offerings are designed to provide value, convenience, and peace of mind. With a focus on innovation and customer satisfaction, JPMCB card services have earned a reputation for excellence in the financial services sector. Their commitment to delivering top-notch services has made them a preferred choice for millions of users worldwide.

As financial needs evolve, so do the features and benefits of JPMCB card services. These cards are not just tools for making payments but also gateways to unlocking exclusive rewards, discounts, and financial management tools. From helping users build credit to offering premium travel benefits, JPMCB card services cater to a broad spectrum of financial goals. Their robust fraud protection systems and 24/7 customer support further enhance the user experience, ensuring that cardholders feel secure and supported at every step.

With the rise of digital banking and contactless payments, JPMCB card services have adapted seamlessly to the changing landscape. Their integration with mobile wallets, online shopping platforms, and global payment networks makes them a versatile choice for modern consumers. Whether you're looking for a card to manage everyday expenses or one that offers exclusive travel privileges, JPMCB card services provide a solution that aligns with your lifestyle and financial objectives. This article dives deep into the world of JPMCB card services, exploring their features, benefits, and how they can help you achieve your financial goals.

Read also:Victoria Chlebowski A Rising Star In Modern Media And Beyond

Table of Contents

- What Are JPMCB Card Services and Why Should You Consider Them?

- How Can JPMCB Card Services Help You Build Credit?

- What Are the Key Features of JPMCB Card Services?

- How to Apply for JPMCB Card Services

- What Are the Eligibility Criteria for JPMCB Card Services?

- How Can You Maximize the Benefits of JPMCB Card Services?

- Frequently Asked Questions About JPMCB Card Services

- Conclusion: Why JPMCB Card Services Are a Smart Choice

What Are JPMCB Card Services and Why Should You Consider Them?

JPMCB card services are a suite of financial products offered by JPMorgan Chase Bank, one of the largest and most reputable financial institutions in the world. These services encompass a wide range of credit card options, each designed to cater to specific customer needs. Whether you're looking for a card with generous cashback rewards, travel benefits, or low-interest rates, JPMCB card services have something for everyone.

One of the primary reasons to consider JPMCB card services is their commitment to customer satisfaction. From the moment you apply for a card to the ongoing support you receive as a cardholder, JPMCB ensures that your experience is seamless and hassle-free. Their user-friendly mobile app and online portal allow you to manage your account, track spending, and redeem rewards with ease. Additionally, JPMCB card services offer features like purchase protection, extended warranties, and price match guarantees, which add significant value to your everyday transactions.

Moreover, JPMCB card services are known for their competitive interest rates and flexible repayment options. This makes them an excellent choice for individuals looking to manage their finances responsibly while enjoying the perks of credit card ownership. With JPMCB card services, you can enjoy the convenience of a credit card without compromising on security or affordability.

How Can JPMCB Card Services Help You Build Credit?

Building a strong credit history is essential for achieving financial stability, and JPMCB card services can play a pivotal role in this process. By using a JPMCB credit card responsibly, you can establish a positive credit score, which is crucial for securing loans, mortgages, and other financial products in the future. But how exactly do JPMCB card services contribute to credit building?

Firstly, JPMCB card services report your payment activity to major credit bureaus. This means that every time you make a payment on time, it reflects positively on your credit report. Consistent, timely payments are one of the most significant factors in determining your credit score. Additionally, JPMCB offers secured credit cards, which are ideal for individuals with limited or poor credit history. These cards require a security deposit, which serves as your credit limit, allowing you to build credit without the risk of overspending.

Another way JPMCB card services help you build credit is by offering tools and resources to manage your finances effectively. For instance, their mobile app provides insights into your spending habits, helping you stay within your budget. They also offer credit monitoring services, which alert you to any changes in your credit report, enabling you to address potential issues promptly. By leveraging these features, you can take control of your financial future and establish a solid credit foundation.

Read also:William Nylander Siblings A Closer Look At Their Lives And Achievements

What Are the Key Features of JPMCB Card Services?

JPMCB card services are packed with features that cater to a wide range of financial needs. From rewards programs to advanced security measures, these cards offer a comprehensive suite of benefits that set them apart from competitors. Below, we explore some of the most notable features of JPMCB card services.

Rewards and Perks

One of the standout features of JPMCB card services is their robust rewards program. Depending on the card you choose, you can earn cashback, travel miles, or points that can be redeemed for merchandise, gift cards, or statement credits. For example, some JPMCB cards offer up to 5% cashback on specific categories like groceries, gas, and dining. Others provide travel perks such as free checked bags, airport lounge access, and exclusive hotel discounts.

Additionally, JPMCB card services often come with sign-up bonuses that can be incredibly lucrative. By spending a certain amount within the first few months of opening your account, you can earn a substantial number of points or cashback. These bonuses can significantly enhance the value of your card, making it a worthwhile investment for savvy consumers.

Fraud Protection and Security

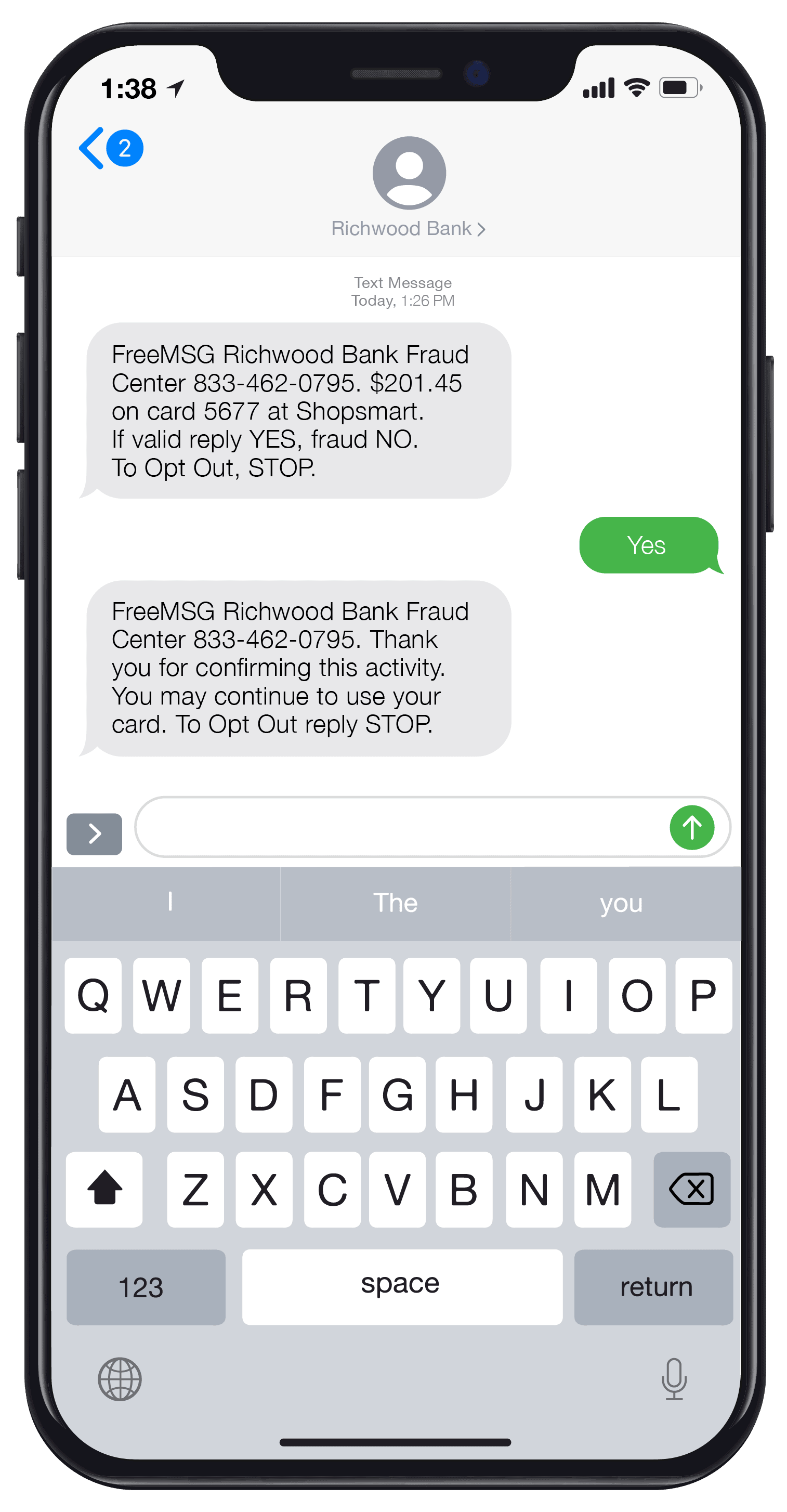

Security is a top priority for JPMCB card services, and they employ cutting-edge technology to protect your financial information. Features like zero liability protection ensure that you're not held responsible for unauthorized transactions. Moreover, JPMCB offers real-time fraud alerts, which notify you of suspicious activity on your account, allowing you to take immediate action.

In addition to fraud protection, JPMCB card services provide tools like virtual card numbers and contactless payments, which enhance your security when shopping online or in-store. These features not only protect your personal information but also provide peace of mind, knowing that your financial data is safeguarded against potential threats.

How to Apply for JPMCB Card Services

Applying for JPMCB card services is a straightforward process that can be completed online or in-person at a local branch. To get started, visit the official JPMorgan Chase website and navigate to the credit card section. From there, you can browse the available options and select the card that best suits your needs. Once you've made your choice, click on the "Apply Now" button to begin the application process.

The application form will require you to provide personal information such as your name, address, Social Security number, and income details. It's essential to ensure that all the information you provide is accurate, as discrepancies can delay the approval process. After submitting your application, JPMCB will review your credit history and financial standing to determine your eligibility. In most cases, you'll receive a decision within minutes, and if approved, your card will be mailed to your address within 7-10 business days.

If you prefer a more personalized approach, you can visit a local JPMorgan Chase branch to apply in person. A representative will guide you through the process, answer any questions you may have, and assist you in selecting the right card for your financial goals. Whether you choose to apply online or in-person, JPMCB card services make the process quick, easy, and hassle-free.

What Are the Eligibility Criteria for JPMCB Card Services?

Before applying for JPMCB card services, it's essential to understand the eligibility criteria to ensure a smooth application process. While the specific requirements may vary depending on the card, there are some general guidelines that apply to most JPMCB credit cards.

First and foremost, you must be at least 18 years old to apply for a JPMCB credit card. Additionally, you'll need to provide proof of income, which demonstrates your ability to repay the credit extended to you. This can include salary, freelance income, or other sources of revenue. JPMCB also considers your credit history, so having a good or excellent credit score significantly improves your chances of approval.

For individuals with limited or no credit history, JPMCB offers secured credit cards that require a security deposit. This deposit serves as collateral and establishes your credit limit. Over time, responsible use of a secured card can help you build credit and eventually qualify for unsecured cards with higher limits and better rewards. By understanding and meeting these eligibility criteria, you can increase your chances of successfully obtaining a JPMCB credit card.

How Can You Maximize the Benefits of JPMCB Card Services?

While JPMCB card services offer a host of benefits, it's essential to use them strategically to maximize their value. By adopting smart spending habits and taking full advantage of the available features, you can make the most of your credit card experience. Below, we explore some practical tips for maximizing the benefits of JPMCB card services.

Strategic Spending

One of the best ways to maximize the benefits of JPMCB card services is by aligning your spending with the card's rewards structure. For example, if your card offers higher cashback on groceries and gas, prioritize using it for these categories. Similarly, if you have a travel rewards card, use it for booking flights, hotels, and other travel-related expenses to earn maximum points.

Another strategy is to take advantage of rotating bonus categories. Many JPMCB cards offer increased rewards on specific categories that change quarterly. By staying informed about these promotions and adjusting your spending accordingly, you can earn significantly more rewards over time. Additionally, always pay your balance in full each month to avoid interest charges and maintain a healthy credit score.

Utilizing Rewards Programs

JPMCB card services provide a variety of rewards programs, and understanding how to use them effectively can enhance your financial benefits. For instance, if your card offers points that can be redeemed for travel, consider booking your trips through the card's travel portal to get the best value. Alternatively, if you prefer cashback, set up automatic redemptions to your bank account or apply them as statement credits to offset your balance.

It's also worth exploring partner programs that allow you to transfer your points to airline or hotel loyalty programs. This can unlock even more value, especially if you frequently travel with specific airlines or stay at particular hotel chains. By strategically utilizing these rewards programs, you can make your JPMCB card work harder for you, providing greater financial flexibility and enjoyment.

Frequently Asked Questions About JPMCB Card Services

How Do I Check My JPMCB Card Balance?

You can check your JPMCB card balance by logging into your account through the official JPMorgan Chase website or mobile app. Once logged in, navigate to the "Account Summary" section, where you'll find detailed information about your current balance