Planning for retirement can feel like navigating a maze, but tools like the Fidelity Retirement Score can simplify the process and provide clarity. This score serves as a personalized benchmark, helping you understand how prepared you are for retirement based on your current financial situation. Whether you're just starting to save or nearing the finish line, the Fidelity Retirement Score offers actionable insights to guide your journey. With its user-friendly interface and data-driven analysis, it empowers individuals to make informed decisions about their financial future.

As retirement planning becomes increasingly complex, tools like the Fidelity Retirement Score have gained prominence. By evaluating factors such as savings, investments, income, and expected expenses, this score paints a comprehensive picture of your readiness for retirement. It's not just a number—it's a roadmap to financial security. By leveraging this tool, you can identify gaps in your strategy and make adjustments to ensure a comfortable retirement.

For those unfamiliar with the Fidelity Retirement Score, understanding how it works and how to interpret it can feel overwhelming. However, breaking it down into manageable components makes it accessible and actionable. From calculating your score to implementing strategies for improvement, this guide will walk you through everything you need to know about maximizing the value of this essential retirement planning tool.

Read also:Victoria Chlebowski A Rising Star In Modern Media And Beyond

Table of Contents

- What Is Fidelity Retirement Score?

- How Is Your Fidelity Retirement Score Calculated?

- Why Is Your Fidelity Retirement Score Important for Your Future?

- What Are the Factors Affecting Your Fidelity Retirement Score?

- How Can You Improve Your Fidelity Retirement Score?

- Fidelity Retirement Score vs. Other Retirement Planning Tools

- Common Mistakes to Avoid When Using Fidelity Retirement Score

- Frequently Asked Questions About Fidelity Retirement Score

What Is Fidelity Retirement Score?

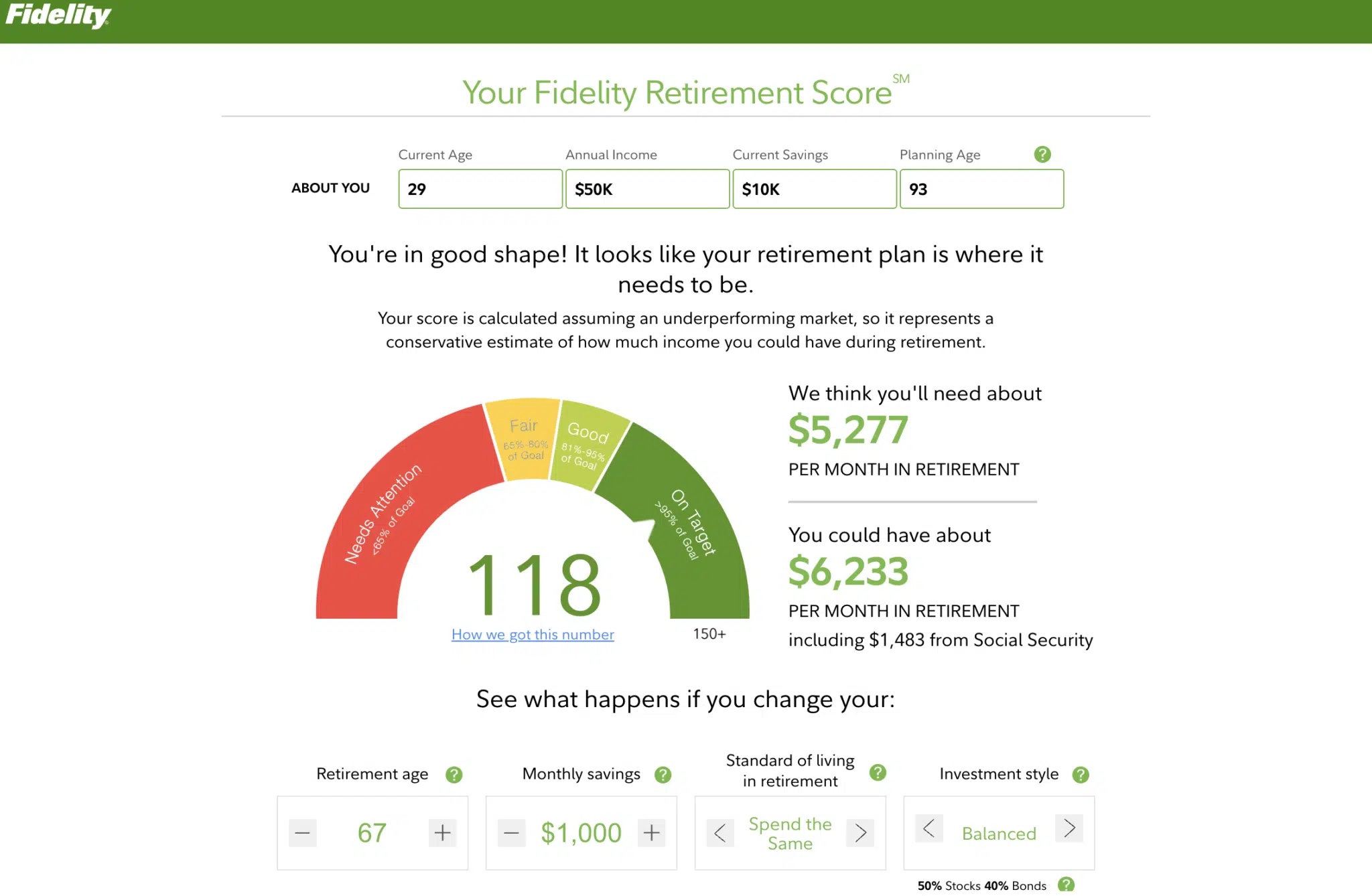

The Fidelity Retirement Score is a tool designed to help individuals assess their retirement readiness. Think of it as a credit score for your retirement planning—it evaluates your financial health and provides a score that indicates how well-prepared you are for retirement. This score is based on a scale, often ranging from 0 to 100, with higher scores indicating greater readiness. By offering a clear snapshot of your financial standing, it empowers you to take actionable steps toward achieving your retirement goals.

The tool takes into account a variety of factors, including your current savings, expected Social Security benefits, investment portfolio performance, and anticipated expenses during retirement. It also considers your age, income, and other personal financial details. This holistic approach ensures that the score reflects your unique circumstances, making it a valuable resource for anyone planning for retirement. Whether you're just starting to save or are close to retirement age, the Fidelity Retirement Score can help you identify areas where you're excelling and areas that need improvement.

One of the standout features of the Fidelity Retirement Score is its accessibility. Available online through Fidelity's platform, it’s easy to use and provides instant results. This convenience makes it an ideal tool for individuals who want to stay on top of their retirement planning without needing to consult a financial advisor. However, it's important to note that while the score is a helpful guide, it should not replace professional financial advice. Instead, it serves as a starting point for deeper discussions about your retirement strategy.

How Is Your Fidelity Retirement Score Calculated?

Understanding how the Fidelity Retirement Score is calculated is key to making the most of this tool. The score is derived from a combination of inputs that reflect your financial situation and retirement goals. These inputs are then processed through a proprietary algorithm that assigns weights to different factors based on their importance. While the exact formula is not publicly disclosed, several key elements are known to influence the final score.

First and foremost, your savings and investment portfolio play a significant role. The tool evaluates how much you've saved in retirement accounts such as 401(k)s, IRAs, and other investment vehicles. It also considers the performance of these investments, including growth potential and risk levels. For example, a diversified portfolio with a mix of stocks and bonds may receive a higher score than one heavily weighted in low-yield savings accounts.

Income is another critical factor. The tool assesses your current income and projects how it might change as you approach retirement. It also considers additional income sources, such as Social Security benefits or pensions. Expenses during retirement, including housing, healthcare, and daily living costs, are factored in to determine whether your savings will be sufficient to cover these needs. By combining these elements, the Fidelity Retirement Score provides a comprehensive evaluation of your financial readiness for retirement.

Read also:Trump Daily Schedule A Comprehensive Look At His Routine And Lifestyle

Why Is Your Fidelity Retirement Score Important for Your Future?

So, why should you care about your Fidelity Retirement Score? The answer lies in its ability to provide clarity and direction for your retirement planning. This score isn't just a number—it's a reflection of your financial health and a predictor of your ability to maintain your desired lifestyle in retirement. By understanding your score, you can take proactive steps to address weaknesses and build on your strengths, ensuring a more secure future.

One of the primary benefits of the Fidelity Retirement Score is its ability to highlight potential gaps in your retirement strategy. For instance, if your score indicates that your savings are insufficient to cover anticipated expenses, it serves as a wake-up call to increase contributions or adjust your investment strategy. Similarly, a high score can provide peace of mind, confirming that you're on the right track and reinforcing the importance of maintaining your current habits.

Another reason the Fidelity Retirement Score is crucial is its role in long-term financial planning. Retirement isn't a one-time event—it's a phase of life that can last decades. The score helps you anticipate future needs and challenges, allowing you to create a sustainable plan. Whether it's accounting for healthcare costs, inflation, or unexpected expenses, the Fidelity Retirement Score equips you with the insights needed to navigate these complexities and achieve financial independence.

What Are the Factors Affecting Your Fidelity Retirement Score?

Several key factors influence your Fidelity Retirement Score, each playing a unique role in determining your overall readiness for retirement. Understanding these factors can help you identify areas for improvement and take targeted actions to boost your score.

Savings and Investments

Your savings and investments are among the most significant contributors to your Fidelity Retirement Score. The tool evaluates the total amount you've saved in retirement accounts, such as 401(k)s, IRAs, and taxable investment accounts. It also considers the performance of these investments, including growth rates and risk levels. A diversified portfolio that balances risk and reward is more likely to yield a higher score than one that's overly conservative or concentrated in a single asset class.

Additionally, the tool assesses whether your savings rate is sufficient to meet your retirement goals. For example, if you're consistently contributing a percentage of your income to retirement accounts, you're more likely to achieve a favorable score. Conversely, inadequate savings or irregular contributions can lower your score and signal the need for adjustments.

Income and Expenses

Income and expenses are equally important factors in calculating your Fidelity Retirement Score. The tool evaluates your current income and projects how it might change as you approach retirement. It also considers additional income sources, such as Social Security benefits, pensions, or part-time work. A stable and predictable income stream can significantly boost your score, as it reduces uncertainty about your ability to cover expenses during retirement.

On the expense side, the tool estimates your anticipated costs, including housing, healthcare, travel, and daily living expenses. If your projected expenses exceed your expected income and savings, your score may reflect this imbalance. By identifying potential shortfalls, the Fidelity Retirement Score encourages you to make adjustments, such as reducing discretionary spending or increasing contributions to retirement accounts.

How Can You Improve Your Fidelity Retirement Score?

If your Fidelity Retirement Score isn't where you'd like it to be, don't worry—there are several strategies you can implement to improve it. The key is to focus on the factors that influence the score and take actionable steps to address any weaknesses. Here are some practical tips to help you boost your score and enhance your retirement readiness.

First, consider increasing your retirement contributions. Whether it's through your employer-sponsored 401(k) plan or an individual IRA, contributing more money to your retirement accounts can have a significant impact on your score. If possible, aim to max out your contributions each year to take full advantage of tax benefits and compound growth. Even small increases can add up over time, thanks to the power of compounding interest.

Next, review your investment portfolio to ensure it's aligned with your retirement goals. A well-diversified portfolio that balances risk and reward can improve your score by demonstrating a strong growth potential. Consider consulting a financial advisor to assess your current investments and make recommendations for adjustments. Additionally, reducing high-interest debt, such as credit card balances, can free up more money for retirement savings and positively impact your score.

Fidelity Retirement Score vs. Other Retirement Planning Tools

When it comes to retirement planning, there are numerous tools available, each with its own strengths and limitations. How does the Fidelity Retirement Score compare to other popular options, and what sets it apart? Understanding these differences can help you choose the right tool for your needs and maximize its benefits.

One key advantage of the Fidelity Retirement Score is its simplicity and accessibility. Unlike some retirement calculators that require extensive input and technical knowledge, the Fidelity tool is user-friendly and provides instant results. This makes it an excellent choice for individuals who want a quick and easy way to assess their retirement readiness. Additionally, the score's holistic approach—considering savings, investments, income, and expenses—ensures a comprehensive evaluation of your financial situation.

However, it's worth noting that other tools may offer more detailed insights or customization options. For example, some retirement calculators allow users to input specific assumptions about inflation rates, healthcare costs, or market performance. While the Fidelity Retirement Score provides a general overview, these tools can be useful for those seeking a more granular analysis. Ultimately, the best approach is to use multiple tools in tandem, leveraging their strengths to create a well-rounded retirement plan.

Common Mistakes to Avoid When Using Fidelity Retirement Score

While the Fidelity Retirement Score is a valuable tool, it's important to use it correctly to avoid common pitfalls. Misinterpreting the score or relying on it too heavily can lead to misguided decisions that may hinder your retirement planning efforts. Here are some mistakes to watch out for and how to avoid them.

One common mistake is treating the score as a definitive measure of your retirement readiness. While it provides valuable insights, it's not a substitute for personalized financial advice. Relying solely on the score without considering other factors, such as your unique goals and risk tolerance, can lead to an incomplete picture. To avoid this, use the score as a starting point and consult a financial advisor for a more tailored analysis.

Another mistake is failing to update your information regularly. Your financial situation is constantly evolving, and an outdated score may not accurately reflect your current readiness. Make it a habit to review and update your inputs periodically, especially after major life events such as a job change, marriage, or the birth of a child. This ensures that your score remains relevant and actionable.

Frequently Asked Questions About Fidelity Retirement Score

What Is a Good Fidelity Retirement Score?

A good Fidelity Retirement Score typically falls in the higher range of the scale, often above 80. However, the ideal score varies depending on your age, income, and retirement goals. For example, someone in their 20s may have a lower score due to fewer years of saving, while someone in their 50s should aim for a higher score to ensure readiness for retirement.

How Often Should I Check My Fidelity Retirement Score?

It's a good idea to check your Fidelity Retirement Score at least once a year or whenever there's a significant change in your financial situation. Regular reviews help you stay on track and make adjustments as needed to improve your